Fall Economic Statement: A Disappointment for Affordable Housing and Homelessness Sector

02 Dec 2020

While the main focus of the FES was to account for COVID related accumulated expenditures to date and to set out a framework for a recovery phase, it was also expected to identify some planned initiatives and new spending in the housing and homeless area. It did not.

In a brief section entitled “Addressing Affordable Housing and Homelessness” the FES frames the challenge:

COVID-19 has exacerbated existing housing affordability and homelessness issues, and called attention to the public health risks of substandard and crowded living quarters. Without urgent action by the Government of Canada, the COVID-19 pandemic could lead to a dramatic increase in homelessness. Affordable housing is also essential for economic fairness and growth. [FES page 86]

A full array of organizations including the FCM, the CAEH, CHRA CFAA and CHF have all submitted pre-budget submissions. And all have called for specific initiatives related to addressing COVID impacts on homelessness and strengthening responses to address persisting (and growing) affordable housing need.

Yet despite the framing rhetoric there was an almost total disregard of these proposals:

The FES:

- Highlights the $1B Rapid Housing Initiative (RHI) previously announced the week of the Throne speech.

- Notably, it substantially increases the budget for the Rental Housing Construction Financing (RCFI) by $12B up to $25.75B.

- It refines the income criteria and thus maximum home prices eligible for the First Time Home Buyer Initiative;

- It proposes to design a federal tax on foreign buyers of homes.

- And buried in a larger Violence Prevention Strategy is some undermined amount for new shelters and transition housing for First Nations, Inuit and Métis peoples across the country, including on reserve, and in the North and in urban areas.

But none of these things will come remotely close to address the urgent action needed to avoid a dramatic increase in homelessness.

But none of these things will come remotely close to address the urgent action needed to avoid a dramatic increase in homelessness.

The RCFI (which at $25.75B accounts for over one third of total NHS planned spending, now up to $68 Billion) appears to be the favoured program of this government and CMHC. Perhaps because it enables announcements of new units funded (albeit falsely claiming that many are affordable units) and because it does not cost anything (it simply takes advantage of a low-rate federal finance facility).

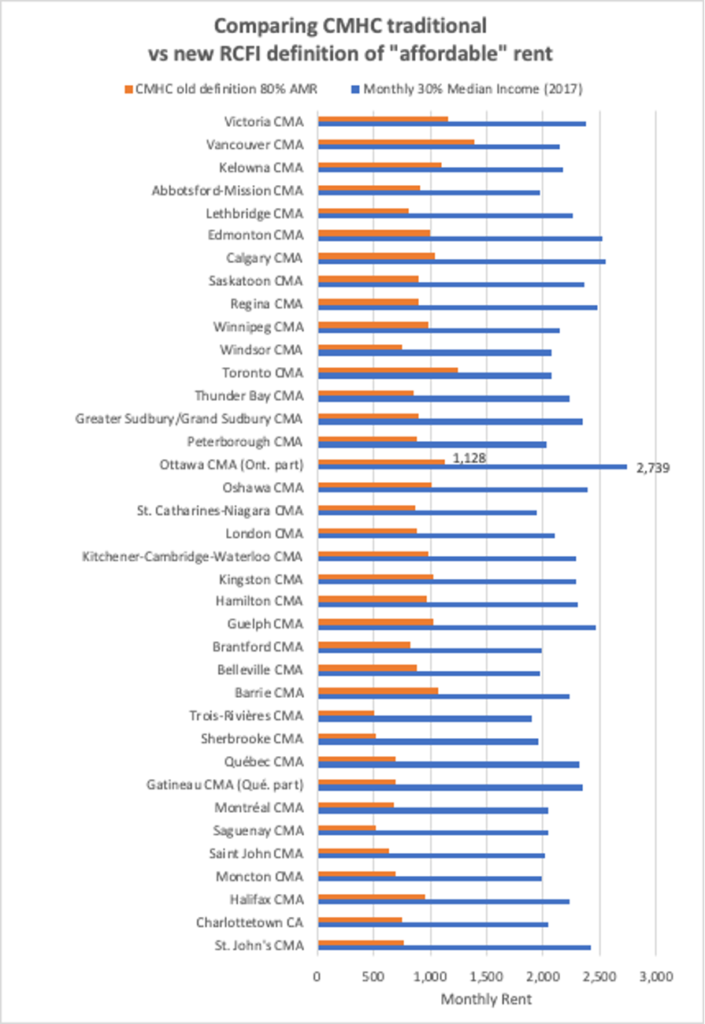

While presented in the funding table under the title Affordable Housing ( sec 3.3.1.11) RCFI does not actually create affordable housing – it is a loan program that seeks to incent market rental development. It notionally requires that 20% of units are “affordable” but continues to rely on a flawed criteria and definition of affordable, effectively nullifying any meaningful level of affordability. As an example, in Ottawa the criteria require that monthly rents be no more than $2,700 per month (30% of median household income).[1] Only when utilized by non-profit developers do unit rents reach down to, or below median rent levels (the basis for CMHC primary affordability metric).

Why substantially increase the funding (or more correctly non-budgetary loan authority) of a flawed program (RCFI), a funding initiative that does not appear to be even needed – rental housing starts had already increased dramatically prior to implementing the RCFI in 2017. Estimates comparing rental starts to announced RCFI funding as of March 2020 suggest that fewer than 5% of new rental construction since 2016 has been financed by the RCFI, so the market is already responding to demand without any help.

This $12B of low cost lending could have been far more effectively deployed for more targeted initiatives, including financing to enable non-profits purchase existing rental assets that are rapidly being acquired by REITs with subsequent rent increases moving the units above affordable levels.

Steve Pomeroy

Senior Research Fellow, Centre for Urban Research and Education (CURE), Carleton University

___________________________

[1] Using 30% of median family income results is rent levels that in all but two cities (CMAs) in Canada are well above 150% of the Average Market Rent (and in some cases above the full potential market level, as illustrated in this Ottawa calculation). See attached chart. If CMHC is continuing to expand the scale of this program, it should also refine and correct the criteria and definition of “affordable” – either using the 80% median market rent, or recalibrate the income measure to reflect the lower median income of rents (at 50% or 60% of median income).